It’s been lengthy predicted that gin’s meteoric rise over the previous fifteen years would sooner or later be adopted by some kind of decline. Some within the trade have taken to calling this second “peak gin” and lots of consider that in some elements of the world— particularly the UK— we’re already previous that time.

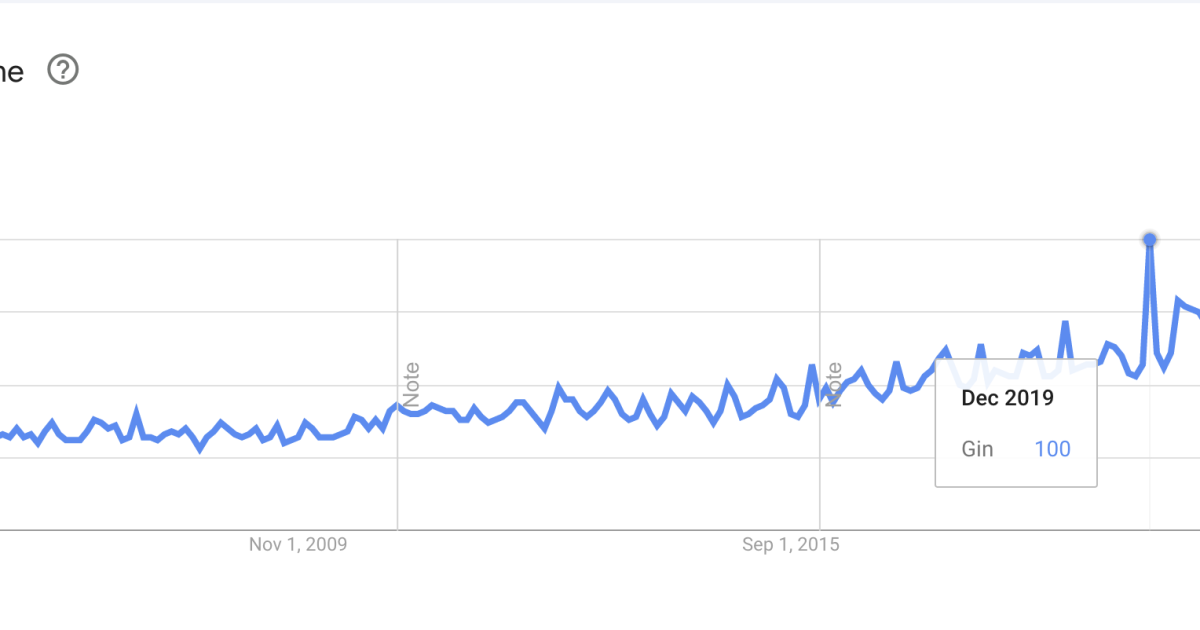

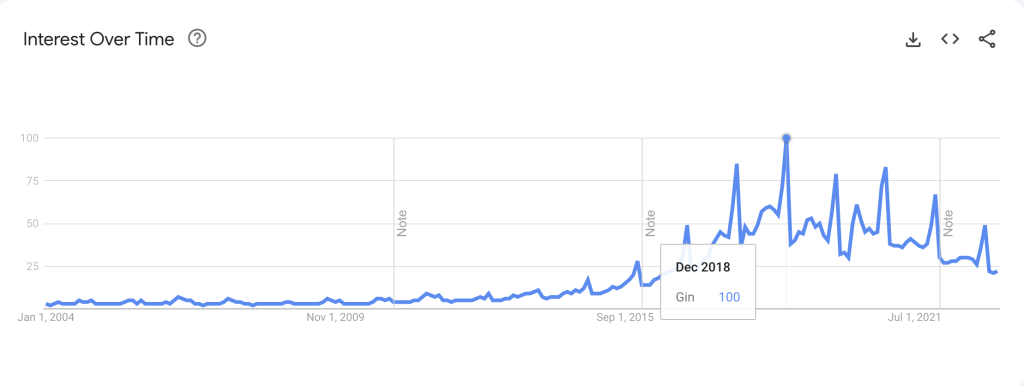

Although some stay bullish and undertaking 11% annual progress within the UK market within the subsequent 5 years, others see the sample that maybe is greatest illustrated by Google Traits— that curiosity in gin within the UK has trailed off precipitously from it’s late ’10s peak. Income has trailed off extra modestly, however it has begun to taper.

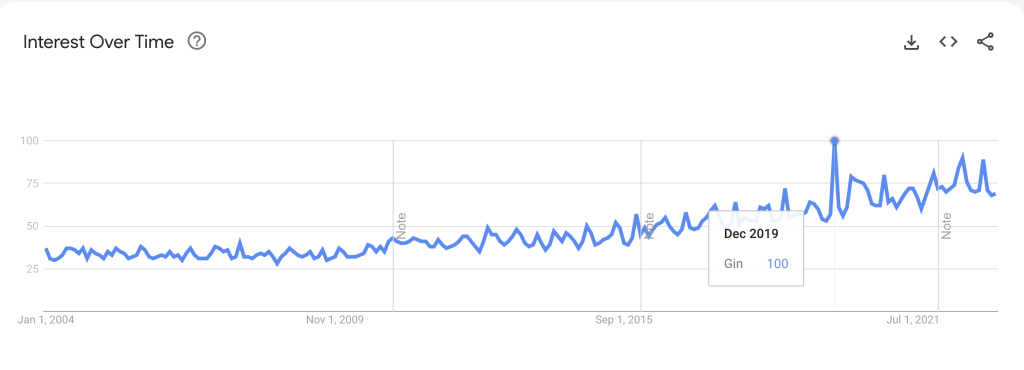

Prognostications for gin progress in america have all the time been extra modest. For instance, progress via 2027 is predicted to be a mere 3.8% yearly. Nonetheless, many have seen america as a market the place the gin scene had not reached its saturation level. In different phrases, if the U.Ok. was seeing a little bit of a backlash, the U.S. was nonetheless ripe with alternative for gin distillers.

“Peak Gin” in america, many thought, was a few years away.

Nonetheless as bullish as I stay on gin personally, there are beginning to be some warning indicators that the U.S. is likely to be in for a little bit of a downturn within the class.

The primary signal is once more in Google Traits. Search curiosity in gin peaked in 2019. Curiosity in gin peaks each December for the vacations. Since then, gin continues to peak annually on the similar time; nonetheless these peaks mirror what was seen within the U.Ok. Traits report. They’re starting to descend.

Additional, regardless of projections of progress, gross sales have barely dipped. These declines in each exterior sentiment and gross sales numbers are at the very least worthy of consideration. The Nationwide Alcohol Beverage Management Affiliation noticed an 5.6% 12 months over 12 months decline of quantity in management states, however a modest 0.2% enhance in worth.

Distillers, particularly smaller craft distillers who’re aiming on the extra premium finish of the market can take solace in that enhance. Whereas the general class is displaying proof of a possible downturn, the decline of cheap manufacturers is greater than being made up for with will increase in gross sales numbers for extra premium choices.

In 2021, one report noticed “the main gin manufacturers above $25 a 750-ml. grew by 11.3%.” Influence Databank noticed progress in 2022, with “super-premium” manufacturers experiencing double digit progress. Gin outpaced different spirits in demand on premise in 2022.

Past the expansion in 2021 and 2022, projections for this market phase stay bullish.

Transferring ahead, in a publish peak-gin world

The trail ahead seems to be one in every of “high quality over amount.” Storytelling and innovation provide distillers a possibility to differentiate themselves inside the area, as shoppers are displaying a willingness to pay for these experiences. Half of U.S. Gin gross sales now come from these segments.

Lots of the leaders of this progress are manufacturers like Hendrick’s, The Botanist and Empress 1908.

Nonetheless discouraging it is likely to be to see that shopper curiosity is likely to be displaying indicators of veering elsewhere, general gin distillers can proceed to take solace within the phase’s worth progress and the shift in consumption traits that may recommend “shopping for much less,” however “shopping for higher.”

Gin is certainly nonetheless in; nonetheless, it’s simply “in” another way.