Chateau Ste Michelle, the Pacific Northwest’s largest vineyard by a mile, has put its flagship Woodinville property up on the market. The 118 acre web site, which incorporates the long-lasting chateau that adorns the vineyard’s labels, was listed earlier this month by CBRE Inc., a business actual property firm based mostly in Dallas, Texas. The worth has not been disclosed. The vineyard can even transfer all of its white wine manufacturing, which has beforehand been going down in Woodinville, to jap Washington.

“With this alteration to our winemaking operations, we’re evaluating find out how to greatest make the most of the power going ahead, together with exploring a possible sale of our Woodinville property, or maybe a portion of it,” Ste Michelle stated in a press release to media. “Whereas a sale of the property has not been predetermined, we’re contemplating all choices as we proceed to search for methods to enhance how we produce our wines, strengthen our dedication to sustainability, and develop the Chateau Ste Michelle model.”

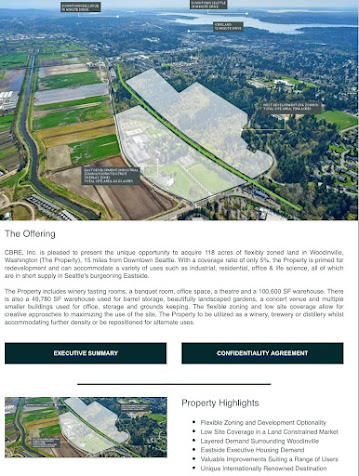

The property itemizing contains Ste Michelle’s chateau, tasting rooms, a banquet facility, workplace area, a theatre, a 100,000+ sq. foot warehouse, and 50,000 sq. ft of barrel storage. The itemizing states that the expansive property is “primed for redevelopment and may accommodate quite a lot of makes use of, similar to industrial, residential, workplace & life science, all of that are in brief provide in Seattle’s burgeoning Eastside.”

Ste Michelle’s 1M+ case white wine manufacturing will transfer to its Canoe Ridge winemaking facility in jap Washington’s Horse Heaven Hills beginning with the 2022 classic. Given the sheer measurement of its white wine efforts, presumably different services will probably be used as properly. Ste Michelle’s crimson wine manufacturing has taken place at Canoe Ridge since 1993. That web site has sometimes had a tasting room through the years however shouldn’t be presently open to the general public.

That is little question true. The vineyard’s huge white wine manufacturing has all the time required coordinating with quite a few different companies to offer fermenting juice and to a lesser extent completed wine to its Woodinville hub, removed from the place the grapes are. Nonetheless, Ste Michelle now not producing any wine at its large facility in Woodinville would absolutely beg the query of whether or not the property was getting used to its fullest worth. The grounds are far too giant and costly to retain as solely workplace area and a tasting room.

Based in 1967, Ste Michelle Vintners moved to Woodinville from Seattle in 1976, constructing a chateau and rebranding itself Chateau Ste Michelle. The property, initially referred to as Hollywood Farm, had been owned by lumber baron Frederick Stimson (1868-1921).

Presumably if Ste Michelle had been to promote the property in full, the vineyard would search for one other area in Woodinville to name residence. The vineyard is simply too synonymous with the city to not retain a robust presence there. If it had been to completely go away Woodinville, the consequences on the realm, western Washington’s wine trade, and Washington wine extra usually can be incalculable.

Over 300,000 guests come to Ste Michelle every year, for tastings and annual summer season concert events on the garden. These guests drive tourism to the city’s wineries, eating places, and different companies. If that had been to stop and even enormously diminish, each vineyard within the space – and actually each vineyard in Washington – can be affected to various levels.

Sparkman, who has a global environmental coverage diploma and who additionally served as an agroforester within the Peace Corps, takes the lengthy view. “This stuff occur in ecosystems the place the mom log breaks down and finally goes away, and it is constructed this thriving ecosystem round it.”

Ste Michelle emphasizes that it’s not absolutely dedicated to promoting its Woodinville property. Reasonably, it’s exploring promoting all or a part of it. The vineyard says, “This course of remains to be within the exploratory section and will take years to implement, if in any respect.”

Given the dimensions and scale of the property in addition to the complexities of its zoning, any sale and subsequent modifications would absolutely not occur shortly. Of notice, over half of the present property is just zoned for residential use. Moreover, the chateau itself is listed within the Nationwide Register of Historic Locations and subsequently is protected.

The itemizing of the property comes as Ste Michelle Wine Estates, the dad or mum firm of Ste Michelle, has fallen on onerous occasions in recent times. Previously owned by tobacco large Altria, the corporate introduced a $292 million stock write-off in addition to $100 million in losses on non-cancellable grape purchases in 2020. Case manufacturing has decreased by greater than 1.2M since 2016. The vineyard, which owned or managed 70% of Washington’s wine grape acreage 10 years in the past, now controls lower than 50%.

In 2021, Ste Michelle was bought by Sycamore Companions, a New York-based non-public fairness agency, for a reported $1.3B. Whereas the corporate indicated on the time its intent to take a position and develop the enterprise, a dedication that’s believed to stay, the sale introduced a lot handwringing within the trade that the corporate and the “string of pearls” that former CEO Ted Baseler helped create is perhaps bought for elements and fast monetary acquire. Baseler retired in 2018 after 34 years on the firm, together with 17 as president and CEO. The corporate has had two CEOs since.

Nonetheless, the hope was that the acquisition by Sycamore would as a substitute enable Ste Michelle to regain its footing and reestablish itself as Washington’s flagship vineyard whereas rising the model. That may nonetheless occur, significantly if Sycamore invests considerably within the vineyard’s development. Nonetheless, Sycamore placing Ste Michelle’s namesake property up on the market appears an ominous flip.

There may be additionally an age-old saying within the state’s wine trade that ‘As Ste Michelle goes, so goes Washington wine.’ If true, these modifications would possibly augur onerous occasions forward for the state’s vintners.

On the similar time, many different Washington wineries are presently flourishing, with a few of their greatest gross sales years ever not too long ago. Different main gamers, similar to Jackson Household Wines, are displaying curiosity in Washington and would possibly finally fill a few of the vacuum created by Ste Michelle dropping winery acreage. Jackson Household bought its first winery in Washington earlier this yr. Ste Michelle pulling again from 1000’s of acres of winery contracts in recent times has additionally opened up alternatives for others, although no vineyard as of but has proven Ste Michelle’s as soon as insatiable urge for food for fruit.

Whether or not Ste Michelle’s Woodinville property is in the end bought or not, the vineyard presently being within the doldrums means Washington’s 1,000-plus wineries which have adopted the corporate’s lead for many years now need to give attention to fending for themselves. That stated, an rising variety of wineries are well-positioned to take action.

In the long run, for a lot of, Ste Michelle and the chateau itself are synonymous with Washington wine. If the corporate in the end sells the chateau and its grounds, it’s going to go away a gap within the coronary heart of Washington wine that can by no means be mended. Furthermore, what’s Chateau Ste Michelle if it has no chateau? The corporate and model would absolutely proceed on in Woodinville or elsewhere, however the lights would exit on Ste Michelle’s shining chateau and grounds.

Graphic from CBRE Inc property itemizing. {Photograph} by Richard Duval.